Saving Taxes with Pet Project

One of Stacy's most endearing qualities was his love and compassion for animals of all shapes and sizes. Over the years, Stacy and his wife, the former Patsye Hester Farthing, had owned numerous breeds of dogs. Many dogs populated his homes thanks to his two children, Trish and Dan, who regularly introduced new members into the family. "We can never forget the influence of our mom either, who supported every critter we brought home including, rabbits, turtles, tadpoles, hamsters, gerbils, guinea pigs, and fish- our house was literally a menagerie," claims Dan Holland.

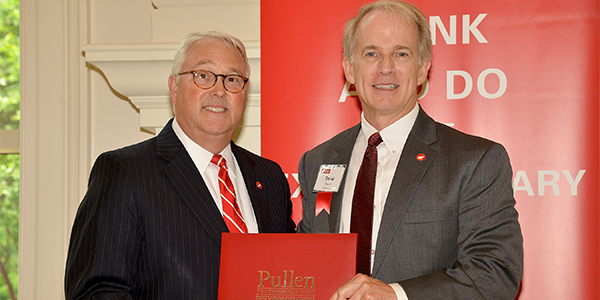

It was Stacy's love and compassion for companion animals that led him to create the Holland Family Scholarship at the NC State University's College of Veterinary Medicine. The Holland Family Scholarship was established to provide financial assistance based on need and academic merit to any student enrolled in the College of Veterinary Medicine who has both an interest and an active involvement in companion animals and shelter medicine through the Campus Community Partnership program.

Trish Holland, a successful Raleigh attorney with a national workplace law firm, and Dan Holland, an industrial organizational psychologist, share their father's passion for animals and enthusiastically contribute to the Holland Family Scholarship each year. They now have the pleasure of meeting the Holland Scholars. "I am very proud of our father for establishing this scholarship, and particularly love the fact that one of the criteria is that the students selected to receive the scholarship must have a demonstrated interest in shelter medicine, since most of our dogs have joined our families from various animal shelters. I particularly enjoy receiving a note from the scholarship recipient each year, as the students always describe in detail his or her love of shelter medicine, what the student has already done to demonstrate that interest, and what he or she intends to do to help homeless animals going forward in their professional careers," Trish said.

Stacy funded the Holland Family scholarship with several types of planned gifts that enabled him to avoid capital gains taxes, income taxes and estate taxes. While setting up his planned gifts in 2005, Stacy said, "This is something that I have been thinking about doing for years. Once I learned the average vet med student's debt load is $100,000, I wanted to lessen that burden for worthy students." He donated appreciated stock and created a charitable gift annuity that provided him with fixed payments during his lifetime and the remainder was added to the Holland Family Scholarship. He also named the Holland Family Scholarship as the beneficiary of his IRA avoiding the potential for subjecting his IRA to income taxes and estate taxes of up to 80% of the value if the IRA had gone to individuals.

Thanks to the generosity of Stacy and his children, this pet project provides annual funding that will help offset some of the expenses for generations of Holland Scholars.