Creating Scholarships While Avoiding Capital Gain Taxes

"NC State contributes a great deal to the state of North Carolina and the expanding universe beyond Raleigh," said David and Celia Jolley, "and we want to see that continue. NC State is a place we can give and support our varied interests."

David and Celia Jolley, both NC State graduates and active members of the university community, turned family property into tax savings, income for life and a lasting Wolfpack legacy while remembering and honoring family members.

"Those being remembered with these scholarships would themselves feel honored to have their names associated with NC State," David and Celia said.

In the early 2000s, the Jolleys transferred ownership of their family farm to a charitable remainder trust which then sold the property, allowing the Jolleys to defer capital gains taxes. Since that time, they have received annual income from the trust and will continue to do so during their lifetimes. After receiving income payments for their lifetimes, the trust will fund the David S. and Celia G. Jolley Enhancement Endowment to provide scholarship, faculty and programmatic support for the College of Humanities and Social Sciences, Poole College of Management, and the College of Education.

The Jolley Endowment will fund the T. B. Wells Sr. and Swan Drake Wells Scholarship, to provide scholarships in the College of Humanities and Social Sciences. This scholarship is in loving tribute to David's great grandparents who originally purchased the farm following the Civil War.

In addition, the Thomas Edward Jolley Sr. and Frances Styles Jolley Scholarship, in memory of David's parents, will provide merit-based scholarships to students enrolled in the Poole College of Management.

The College of Education will also benefit. The Matilda Ray Wells, Swan Drake Wells and Martha Carter Wells Styles Scholarship, in honor of David's cousin, great aunt and grandmother, will provide scholarships to students enrolled in the college. The David S. and Celia G. Jolley Endowment, in honor of Celia's parents, will provide discretionary resources to the Dean of the college. The Frances S. and Thomas E. Jolley Scholarship, in memory of David's parents, will provide merit scholarship support for College of Education students.

The Robert and Susie Wimberly, W.L. and Vivian N. Harris, and P.S. and Sara Jones Scholarship, in memory of David's godparents, will provide funding to the Deans in the Colleges of Education, Humanities and Social Sciences, and Management to help recruit merit scholars from Nash or Edgecombe counties.

The David S. and Celia G. Jolley Colonial Williamsburg Endowment will provide funding for the Dean of the College of Humanities and Social Sciences to cover the costs of faculty who wish to study the archival and other materials available in Williamsburg, Virginia.

It also is not a coincidence that Celia and David honored her parents, Dorcas and Edward J. Gomelda, by naming the reception area of the William and Ida Friday Institute for Educational Innovation. The Gomeldas were both lifelong educators who, through their dedication and service, touched the lives of many North Carolina students. It is indeed fitting for their names to grace the entrance of the Friday Institute that was created to advance education through innovation in teaching, learning and leadership.

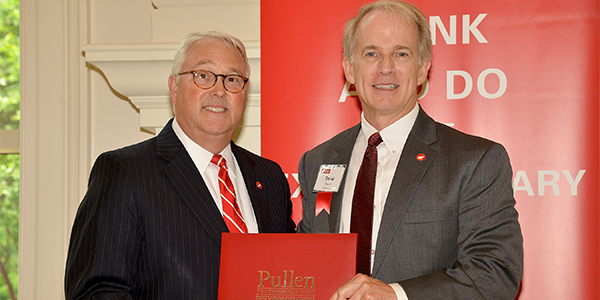

David Jolley '70 has been an active member of the NC State community for many years and has served in numerous volunteer roles including vice chair of the NC State Foundation, president of the College of Education Advisory Board, and member of the Endowment Board and the CHASS Advisory Board.

Celia Jolley, who earned her master's in education from NC State in 1983, has been equally generous with her time and talents, serving on various committees including the College of Education Advisory Board, the Education and Psychology Foundation, and the Leadership Advisory Board of Education.

For more information on how you can use appreciated securities or real estate to save on taxes, receive an income stream, and create your own NC State legacy, please contact the Office of Gift Planning at 919-515-5106 or [email protected].